san antonio local sales tax rate

This rate includes any state county city and local sales taxes. Local Code Local Rate Total Rate.

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

The current total local sales tax rate in San Antonio Heights CA is 7750.

. Texas Comptroller of Public Accounts. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. Jurors parking at the garage.

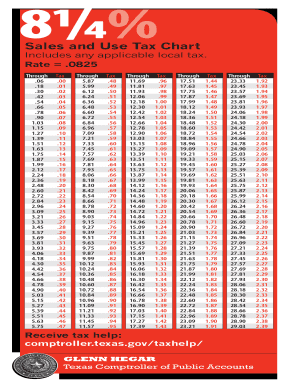

The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax. The December 2020 total local sales tax rate was also 7750. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax.

The San Antonio Texas general sales tax rate is 625. 2020 rates included for use while preparing your income tax deduction. San Antonios current sales tax rate is 8250 and.

The sales tax jurisdiction. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for San Antonio Texas is.

This is the total of state and county sales tax rates. 2020 rates included for use while preparing your income tax deduction. The Texas sales tax rate is currently.

This rate includes any state county city and local sales taxes. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. The latest sales tax rate for San Antonio NM.

The portion of the sales tax rate collected by San Antonio is 125 percent. The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special. The County sales tax.

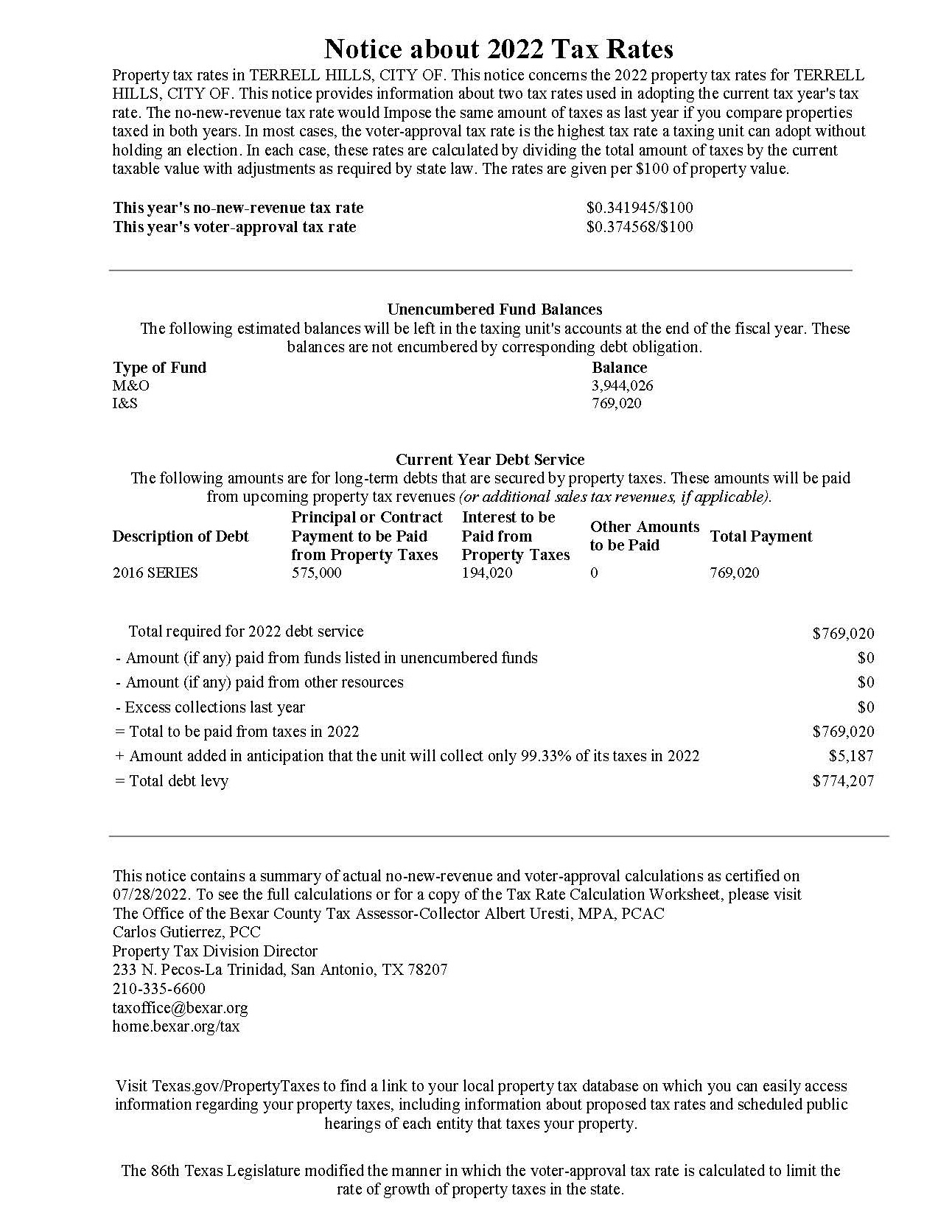

Maintenance Operations MO and Debt Service. The property tax rate for the City of San Antonio consists of two components. 2020 rates included for use while preparing your income tax.

The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use tax. The latest sales tax rate for San Antonio TX. There is no applicable county tax.

The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a. City sales and use tax codes and rates. The minimum combined 2022 sales tax rate for Bexar County Texas is.

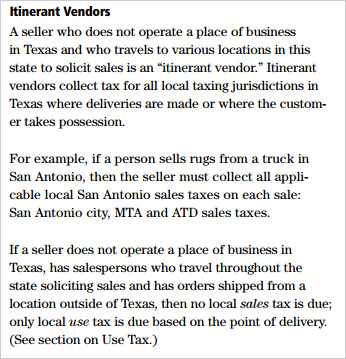

Rates will vary and will be posted upon arrival. 2018 rates included for use while preparing your income tax. In Texas the total local sales tax rate in any one particular location that is the sum of the rates levied by all local taxing authorities can never exceed 2 percent.

Real property tax on median home. The Fiscal Year FY 2023 MO tax rate is 33011 cents per 100 of taxable value. The latest sales tax rate for San Antonio TX.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The Texas state sales tax rate is currently. This includes the rates on the state county city and special levels.

The latest sales tax rate for San Antonio FL. Sales Tax State Local Sales Tax on Food. Every 2019 combined rates mentioned.

This rate includes any state county city and local sales taxes. The sales tax jurisdiction. This rate includes any state county city and local sales taxes.

The 825 sales tax rate in San Antonio consists of 625 Puerto Rico state sales tax 125 San Antonio tax and 075 Special taxThere is no applicable county tax. Sales and Use Tax. The average cumulative sales tax rate in San Antonio Texas is 822.

While many other states allow counties and other localities to collect a local option sales tax Texas does. San Antonio has parts of it located within Bexar.

Texas Income Tax Calculator Smartasset

Most Texans Pay More In Taxes Than Californians Reform Austin

U S Cities With The Highest Property Taxes

Texas Clarifies Proper Calculation Of Sales Tax Avalara

Market Information Schertz Economic Development Corporation

San Antonio Sales Tax Rate Is Second Lowest Among 13 Texas Cities Studied San Antonio Business Journal

Millions In Texas Tax Dollars Are Being Diverted To Another Town Or Huge Online Retailers Like Best Buy

.png)

State And Local Sales Tax Rates In 2014 Tax Foundation

Sales Tax Chart Fill Out And Sign Printable Pdf Template Signnow

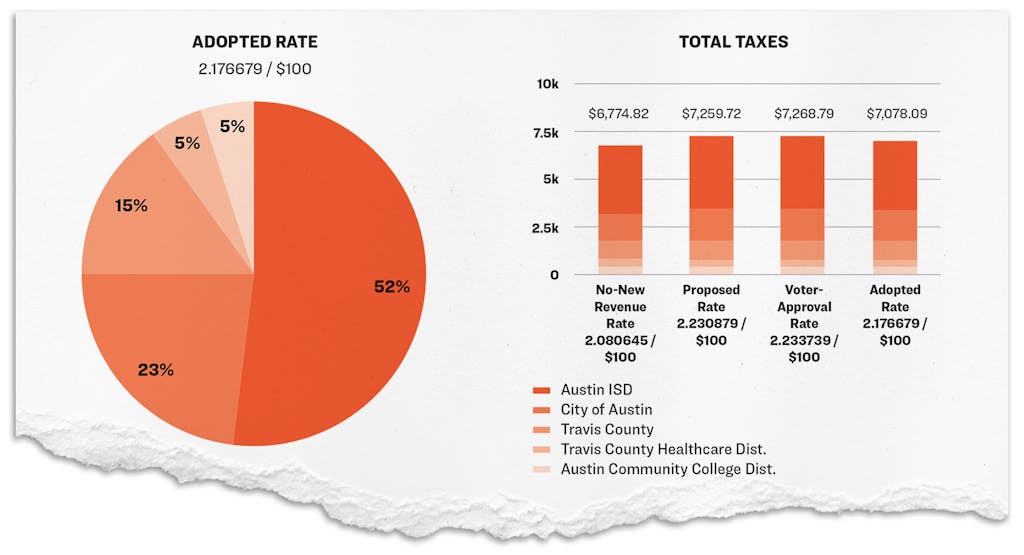

Which Texas Mega City Has Adopted The Highest Property Tax Rate

State And Local Sales Tax Rates In 2017 Tax Foundation

Florida Sales Tax Rates By City County 2022

San Antonio Government 101 Learn How City County Are Run

Texas Sales Tax Rates By City County 2022

How Texas Spends Its Money How Texas Gets Its Money Why It Doesn T Add Up

10 Things To Know Before Moving To San Antonio Tx

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25